Receivables Insurance. Why Now?

Canadian Businesses are at Risk

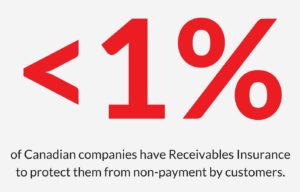

There are 1.1 Million Employer Businesses in Canada and most are not mitigating their risk with Receivables Insurance.

Isn’t it time to get your assets covered? We can help.

Understand Trade Credit Insurance in 30 Minutes

and Why You Should

Insure to Endure explores how trade credit insurance/receivables insurance helps businesses manage financial and operational risk in today’s global economy. The course explains how receivables insurance protects against buyer default, improves access to financing, stabilizes cash flow, supports market expansion, strengthens competitive credit terms, and provides ongoing risk intelligence. By the end, you’ll understand how trade credit insurance goes beyond protection to become a strategic tool for growth, liquidity, and resilience amid economic uncertainty.

Canada's ONLY Accredited Suite of Receivables Insurance Training

The Receivables Insurance Association of Canada (RIAC) has developed the only accredited suite of receivables insurance training in Canada to help brokers, bankers and business owners better understand Receivables Insurance. Also known as credit insurance or trade credit insurance, it is a valuable tool that helps businesses trade and grow securely.

Our News Source & Podcast

TradeSecurely.ca a business and trade website with current news, reports, and analysis on trade-related economic issues and events. TradeSecurely the podcast discusses how Canadian businesses can trade and grow securely. Listen to our latest episode “Go Global with Confidence” with credit and collections expert Hanif Patel.

Understanding Receivables Insurance

Expanding into New Markets?

The Impact of a Bad Debt Loss

A Business Multi-Tool

CFO’s Best Friend

Selling on Open Credit Terms

for Domestic Sales

for Export Sales

Choosing a Policy

WE ARE CANADIANS

Helping Canadian Business Trade & Grow Securely

RIAC’s members are Receivables Insurance Brokers and Providers on the frontline of risk mitigation for businesses in Canada. Our members help Canadian companies grow and succeed by providing them with tools to trade securely at home and abroad.