The biggest uninsured exposure facing Canadian businesses today?

Accounts Receivable

Receivables Insurance, also known as credit insurance or trade credit insurance, provides property and casualty brokers with an ongoing strategic service opportunity that is highly valued by CEOs, CFOs, shareholders, Credit Managers and Enterprise Risk Managers. A Receivables Insurance policy protects corporate balance sheets against unforeseen domestic and export buyer failure and political turmoil. Unlike their counterparts in countries with a more mature trading tradition, many Canadian businesses believe they require Receivables Insurance only if they are trading with foreign buyers. While untrue, this perception helps explain why less than 10,000 companies among the country’s 1.1 million employer businesses currently employ receivables insurance products.

This 15 minute presentation provides an overview of how this lack of awareness and vastly under-served market represents an excellent new opportunity for brokers.

Want to learn more? Reach out to one of our members or take one of our accredited continuing education courses.

For Generalist Brokers

Protect Your Clients - Grow Your Business

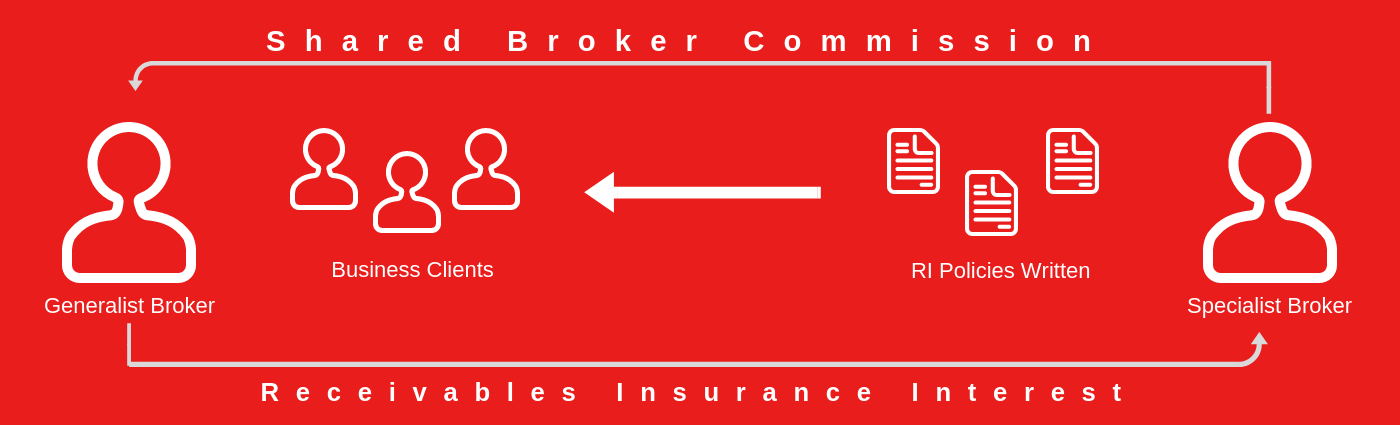

Outsource Your Receivables Insurance Business to a Specialist Broker who has the Expertise. Receivables Insurance (RI) can provide a number of benefits to the generalist broker who serves business clients.

The generalist broker can provide an enhanced level of risk management advice by outlining how RI can protect what is most certainly their largest asset, accounts receivable. As a broker, if you are not providing this service you may be increasing your exposure to potential E&O issues or could be leaving your business open to a full service provider who will provide RI coverage services.

Providing Receivables Insurance does not have to be a daunting task. Generalist brokers can outsource the RI side of their business to a trusted specialist broker who can seek out the policy that best suits the client and provide the RI expertise required. The generalist broker maintains the client relationship and receives a commission on any policies written. As a member of RIAC, generalist brokers have access to these specialist members and can leverage their RI expertise to enhance their own offerings to their customers.

This can increase a generalist broker’s revenue, and reduce E&O, while not threatening their broker relationship with their client. Its a win-win-win for all.

Help Business Clients Succeed

Brokers have an opportunity to super-serve their business clients by staying in touch with receivables insurance providers and keeping abreast of changes in the market that could affect their clients.

Learn more here or complete the form and we’ll be in touch.

Learn About Being an RI Broker

If you would like to learn more about the role of the RI broker or the training courses that are available to them please fill out this form.